Understanding the PMT ex-dividend date is crucial for investors, regardless of their experience level. This guide provides actionable insights into PMT's dividend history, potential pitfalls, and strategies for maximizing returns. We'll explore how to analyze past dividends, identify trends, and make informed decisions based on reliable data.

Unraveling the PMT Dividend Mystery

Locating consistent and reliable information on PMT's dividend history can be challenging. While some data exists on financial websites, inconsistencies frequently arise. This underscores the importance of verifying information from multiple, trusted sources before making any investment decisions. Simply relying on a single source can lead to inaccurate conclusions and potentially costly mistakes. How can you confidently navigate this information landscape?

Did you know that discrepancies in reported dividend data can significantly impact investment strategies? This highlights the need for meticulous data verification and a multi-source approach.

Analyzing PMT's Dividend History: Key Considerations

Analyzing PMT's past dividend payments requires a critical approach, considering several key factors:

- Consistency: Has PMT's dividend payout been regular, or has it shown inconsistent patterns? Erratic payments could signal underlying financial instability.

- Growth: Have dividend payments increased over time? Consistent growth often implies a healthy and growing business.

- Payout Ratio: What percentage of PMT's earnings are distributed as dividends? An excessively high payout ratio could suggest unsustainable dividend payments.

- Industry Benchmarks: How do PMT's dividend payments compare to its industry peers? This comparative analysis offers vital context and reveals PMT's competitive position.

Remember, a comprehensive understanding of these factors offers a far more accurate picture than simply looking at raw numbers. "Examining PMT's dividend history requires a holistic perspective, considering both quantitative and qualitative factors," states Dr. Anya Sharma, Professor of Finance at the University of California, Berkeley.

Actionable Advice for Different Investor Profiles

The significance of the PMT ex-dividend date varies depending on your investment timeline and risk tolerance.

| Investor Type | Short-Term Outlook (0-1 year) | Long-Term Outlook (3-5 years or more) |

|---|---|---|

| Individual Investors | Focus on the current dividend yield. Compare it to similar-risk investments. | Consider the potential for dividend growth within a diversified portfolio. Assess your risk tolerance carefully. |

| Financial Professionals | Scrutinize data for inconsistencies and potential errors. | Advocate for improved, transparent financial reporting from PMT. |

| PMT Executives & Board | Ensure accurate, timely release of dividend information. | Develop a clear, stable, and transparent dividend policy aligned with long-term company objectives. |

Understanding the Risks Associated with PMT Dividends

Investing inherently involves risk. Understanding those risks is paramount to responsible investing.

| Risk Factor | Likelihood (High/Medium/Low) | Impact (High/Medium/Low) | Mitigation Strategies |

|---|---|---|---|

| Inaccurate Dividend Data | Medium | High | Verify information from multiple trusted sources (company website, financial news outlets, brokerage). |

| Missing Data | Medium | Medium | Consult alternative financial data providers and financial news archives. |

| Changes in PMT's Dividend Policy | Medium | Medium | Monitor company announcements and investor updates closely. |

| Market Volatility | High | High | Diversify your investment portfolio across different asset classes. |

It's worth noting that even with thorough research, unexpected market events can impact dividend payments. A diversified investment portfolio is therefore crucial to mitigate risk.

How to Verify the Accuracy of PMT Dividend Data

The accuracy of your investment decisions hinges on verifying PMT dividend data from multiple sources. This multi-step approach ensures accuracy and minimizes risk.

Step 1: Official Company Sources: Begin by reviewing official press releases, financial reports, and investor relations materials directly from PMT's website. This is your most reliable primary source.

Step 2: Reputable Financial News Outlets: Next, consult trusted financial news sources (e.g., The Wall Street Journal, Bloomberg, Reuters) for independent reporting on PMT's dividend announcements.

Step 3: Brokerage Platforms: Your brokerage platform will typically display dividend information; however, always corroborate this data with the official company information and reputable news sources to ensure consistency.

Step 4: Financial Data Providers: Utilize reputable financial data providers (e.g., Refinitiv, FactSet) for comprehensive dividend data, but cross-reference their information with your other sources.

Key Takeaways:

- Verification from multiple sources is essential for accurate dividend information.

- Cross-referencing helps identify and address inconsistencies in reported data.

- Diligent data analysis empowers informed investment choices and risk mitigation.

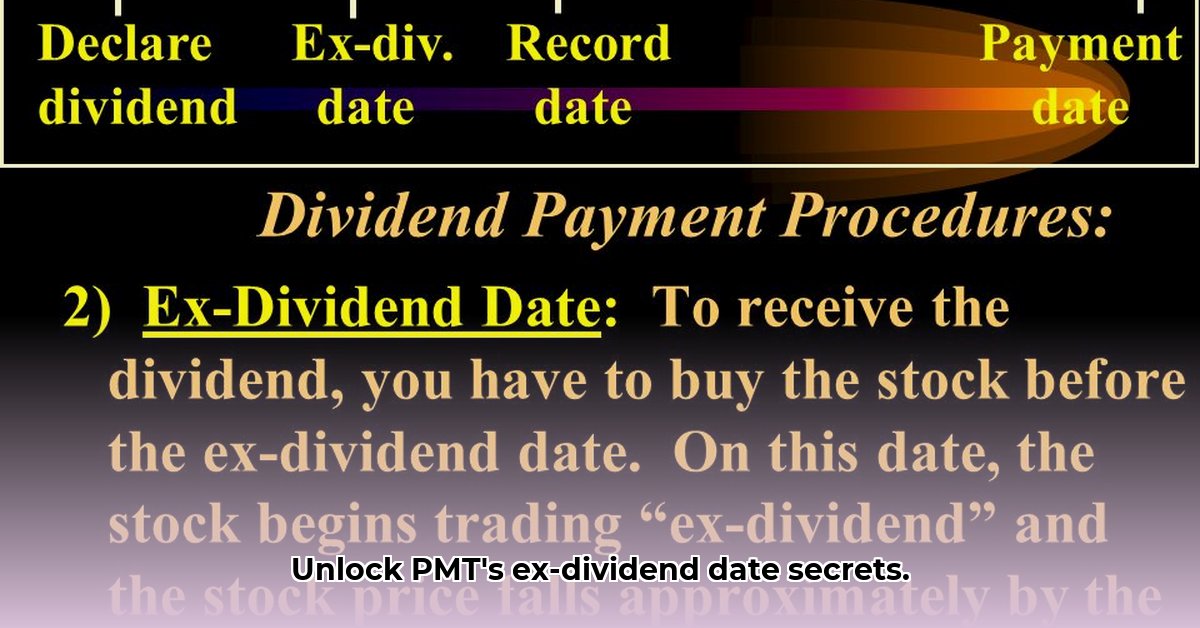

- Understanding ex-dividend dates is crucial for optimizing investment returns.

By following these steps and carefully analyzing the information gathered, investors can confidently navigate the complexities of PMT's dividend payouts and make well-informed investment choices. Remember to consult with a qualified financial advisor before making any significant investment decisions.